Go with OTA or Book Direct? Here’s how to decide

These days, online travel agencies (OTAs) like Trip.com, Agoda, and Booking.com often feature hotel rates that are cheaper than booking directly with hotels.

While a lot of times the OTA is the more affordable choice, is that a good reason to skip booking directly with the hotel ?

In this post, we’ll dive into the numbers to shed light on this niche topic.

Direct vs OTAs

The most obvious reason to book directly with hotels is to leverage your elite status—a topic we’ve covered in our previous post on hotel elite programs.

Direct bookings often come with valuable perks such as free breakfast, room upgrades, and late checkouts. On top of that, booking directly lets you earn hotel points, adding even more value to your stay.

It might feel natural to choose direct bookings when the price difference between OTAs and hotel rates is minimal, assuming the value of hotel points will bridge the gap. But is that really true?

Let’s crunch some numbers to find out.

How much is one hotel point worth?

Here’s a quick recap of the stay earn rates for the Famous 5 hotel loyalty programs, along with the fair market value of the respective hotel points.

|

Loyalty Program |

Stay Earn Rate (PPR)* |

Fair Market Cost(CPP)^ |

|---|---|---|

| Accor Live Limitless |

0.54 (2 per EUR) |

9.40 (0.2 in EUR) |

| Marriott Bonvoy |

2.24 (10 per USD) |

3.97 (0.89 in USD) |

| Hilton Honors |

2.22 (10 per USD) |

2.25 (0.5 in USD) |

| IHG One Rewards |

2.22 (10 per USD) |

2.25 (0.5 in USD) |

| World of Hyatt |

1.1 (5 per USD) |

8.65 (1.92 in USD) |

* Stay Earn Rate (PPR): Typical base earn rate in Points Per Ringgit when you book your stay directly on the hotel website. The rate excludes elite bonuses or promotional multipliers. The rate will be lower for budget brands like iBis.

^ Fair Market Cost (CPP): Typical cost in ringgit cents per point (CPP) during bonus campaigns. Accor points can’t be purchased directly, so we use absolute redemption value of 9.40 CPP.

The fair market price is basically the price you can typically purchase points for during promotions on Points.com.

You can use it as baseline to determine how much one hotel point is worth, assuming you can consistently redeem hotel rooms at values equal to or greater than the fair market price of the hotel points.

While this isn’t always the case, we’ll address that nuance later.

Now, let’s introduce Yield, which is how much value you get back in points for every ringgit you spend when you book directly with the hotel.

We also like to think of it as a Hotel Rebate, highlighting the return in terms of Hotel Points value. This is the base value you get back for direct hotel booking.

|

Loyalty Program |

Stay Earn Rate (PPR)* |

Fair Market Cost(CPP)^ |

Yield/ Hotel Rebate |

|---|---|---|---|

| Accor Live Limitless |

0.54 (2.5 per EUR) |

9.40 (0.2 in EUR) |

5.0% |

| Marriott Bonvoy |

2.24 (10 per USD) |

3.92 (0.87 in USD) |

8.7% |

| Hilton Honors |

2.24 (10 per USD) |

2.23 (0.5 in USD) |

5.0% |

| IHG One Rewards |

2.24 (10 per USD) |

2.23 (0.5 in USD) |

5.0% |

| World of Hyatt |

1.1 (5 per USD) |

8.98 (1.92 in USD) |

9.6% |

* Stay Earn Rate (PPR): Typical base earn rate in Points Per Ringgit when you book your stay directly on the hotel website. The rate excludes elite bonuses or promotional multipliers. The rate will be lower for budget brands like iBis.

^ Fair Market Cost (CPP): Typical cost in ringgit cents per point (CPP) during bonus campaigns. Accor points can’t be purchased directly, so we use absolute redemption value of 9.40 CPP.

Hotel Rebate with Elite Bonus Multiplier

The rate above did not factor in the bonus that you get according to your hotel elite status level. Now, let’s factor in the bonus multiplier for different elite levels across the hotel programs:

| Loyalty Program |

Elite Tier |

Elite Bonus Multiplier |

Yield/ Hotel Rebate (%) |

|---|---|---|---|

| Accor Live Limitless |

Member | 1.00 | 5.0% |

| Silver | 1.24 | 6.2% | |

| Gold | 1.48 | 7.4% | |

| Platinum | 1.76 | 8.8% | |

| Diamond | 2.00 | 10.0% | |

| Marriott Bonvoy |

Member | 1.00 | 8.7% |

| Silver | 1.10 | 9.6% | |

| Gold | 1.25 | 10.9% | |

| Platinum | 1.50 | 13.0% | |

| Titanium | 1.75 | 15.2% | |

| Hilton Honors |

Member | 1.00 | 5.0% |

| Silver | 1.20 | 6.0% | |

| Gold | 1.80 | 9.0% | |

| Diamond | 2.00 | 10.0% | |

| IHG One Rewards |

Member | 1.00 | 5.0% |

| Silver | 1.20 | 6.0% | |

| Gold | 1.40 | 7.0% | |

| Platinum | 1.60 | 8.0% | |

| Diamond | 2.00 | 10.0% | |

| World of Hyatt |

Member | 1.00 | 9.6% |

| Discoverist | 1.10 | 10.6% | |

| Explorist | 1.20 | 11.5% | |

| Globalist | 1.30 | 12.5% |

Hotel elite programs reward you with higher multipliers as you climb the status tiers.

A standout here is Marriott Bonvoy, giving you up to 15% Hotel Rebate at the Titanium level.

Another standout here is World of Hyatt, giving you a high ~9.6 % Hotel Rebate for just being a normal member, but the Hotel Rebate doesn’t really increase much as you climb higher in elite levels.

How to utilise the Hotel Rebate benchmark

The Yield/Hotel Rebate serves as a useful benchmark when comparing the price difference between OTA and direct bookings. If the OTA price is cheaper by less than the benchmark Hotel Rebate rate, it’s often better to opt for a direct booking to maximize the value of hotel points and elite perks.

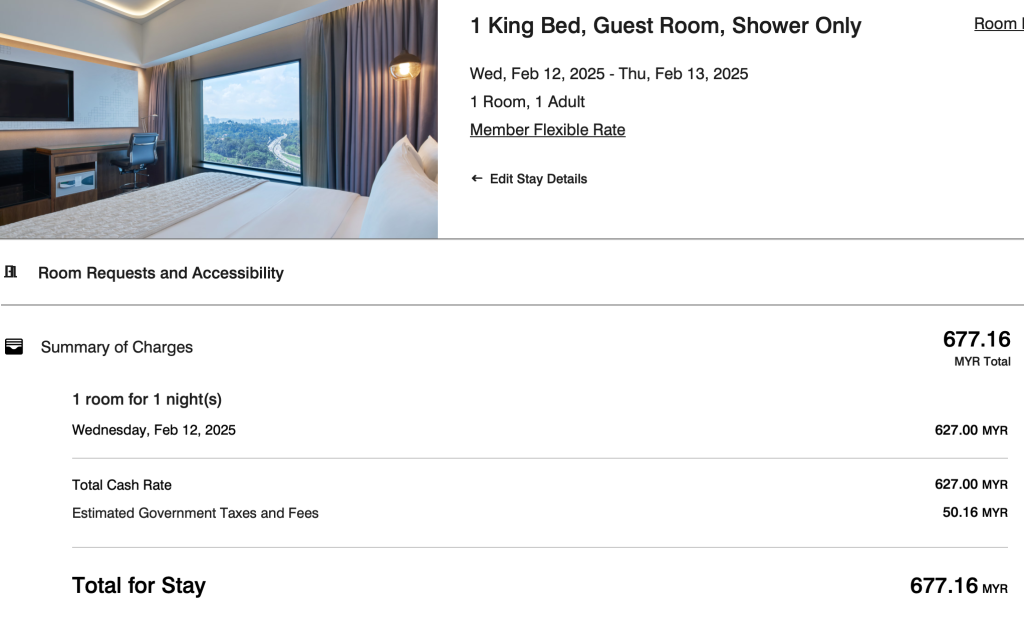

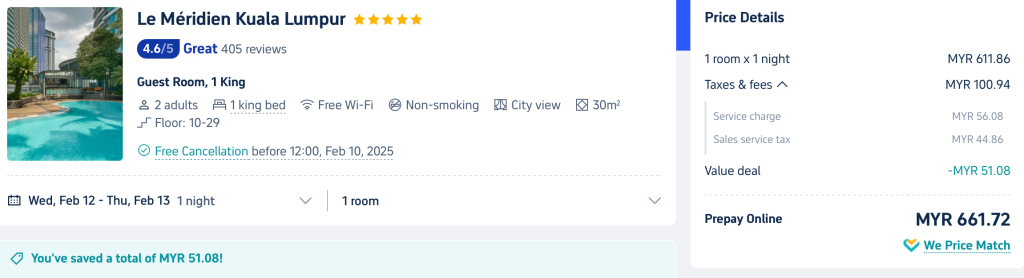

Let’s take a look at an example. Let’s say that you are a Marriott Gold member looking to book a room at Le Meridien Kuala Lumpur:

For the same date and room type, direct booking with Marriott costs RM677, while Trip.com costs RM661.7.

Hence, the cost of booking is ~2.4% cheaper on Trip.com.

However, as a Marriott Gold member, your Hotel Rebate is ~11%. In this case, since the cash saving on Trip.com is only 2.4%, it might be more beneficial to book directly with Marriott to take advantage of the bonus hotel points and potential room upgrade.

That said, OTAs often offer additional discounts, such as credit card promotions (e.g., Agoda) or cashback through platforms like ShopBack. These should be factored into your decision.

Even if we include a 5.5% cashback from ShopBack for Trip.com, the combined savings still fall short of the 11% Hotel Rebate you’d earn by booking directly with Marriott—not to mention the added value of elite benefits.

Keep in mind that this won’t always be the case, as OTA rates can sometimes be significantly lower. We recommend using the Hotel Rebate table above as a benchmark to make an informed decision for each booking.

Fair market price does not always equal value

The fair market cost of points doesn’t always match the redemption value you receive. In many cases, the redemption value may fall short of the fair market cost.

For instance, while Marriott’s fair market cost is approximately 4 cents per point (CPP), it’s common to find redemption values that are lower than 4 CPP.

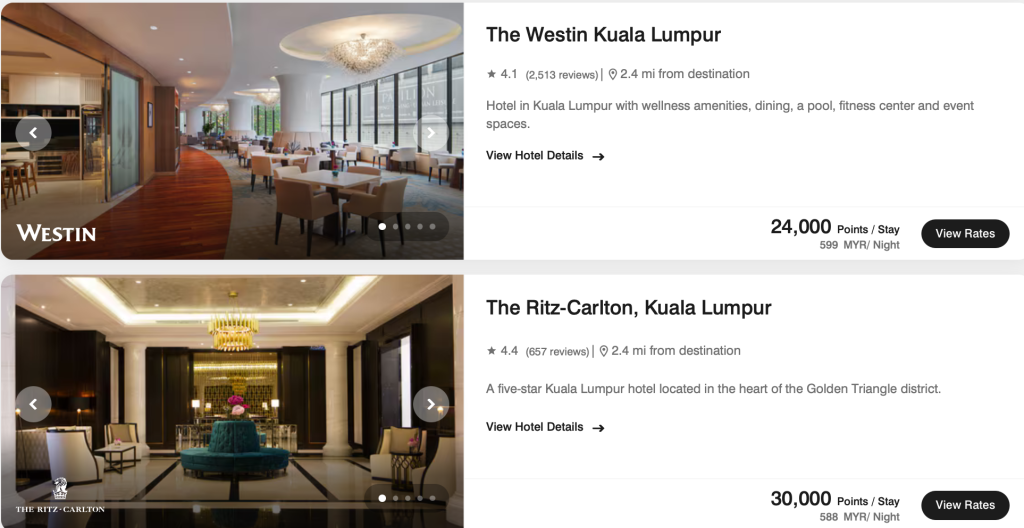

Take a look at this example for The Westin and The Ritz-Carlton Kuala Lumpur.

The Westin: RM599 / 24,000 Points = 2.5 CPP

The Ritz-Carlton: RM588 / 30,000 Points = 1.96 CPP

The redemption value for both of these hotels often falls short of the fair market price.

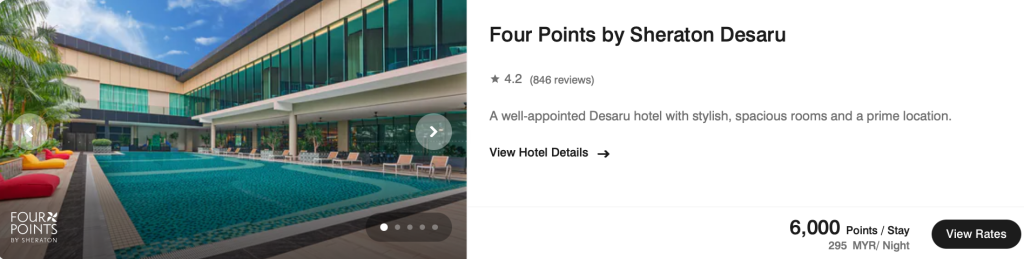

On the flip side, you can sometimes achieve higher redemption values, but these are usually found at the extremes of the pricing spectrum—either at the lowest or highest end. Here’s an example of the lower end:

Four Points by Sheraton Desaru: RM296 / 6000 points = 4.9 CPP

The Ritz-Carton Maldives, Fari Islands: RM9570 / 106000 points = 9.0 CPP

Therefore, there is a level of uncertainty to keep in mind when using the Hotel Rebate benchmark. It assumes that you can—and are willing to—redeem your points in the future at a rate equal to or higher than the Fair Market Price. If this isn’t achievable, the actual value of the rebate may be lower than expected.

The exception for this is Accor, which offers always-fixed redemption value at 9.4CPP.

Quick Estimation

The Hotel Rebate benchmark can guide your decision between direct booking and OTAs. However, there’s no need to calculate everything down to the last detail every time — sometimes a quick estimation is all you need:

- If you’re a Gold member or above, use a ballpark Hotel Rebate of around 10% to estimate (agak-agak) the difference and factor in value of breakfast and potential room upgrade as well.

- If you’re a normal or Silver member with the hotel chain, OTA is probably the better choice if the rate is cheaper (except World of Hyatt)

Conclusion

Booking from OTA can often times be cheaper, but it is better if you use the Hotel Rebate benchmark to guide your decision. We hope this post has given you some insight on this topic.

See you in the next post!